The BEST Way To Find Cheap Car Insurance in Florida.

We've helped 12,000+ Florida residents find cost-effective, and hard-to-place auto insurance.

View our pricing and start quotes in seconds today!

Real Reviews from Florida Drivers

At 5-Star Insurance, we help drivers across Florida get insured quickly and affordably even in challenging situations. Whether it’s handling SR-22 and FR-44 filings or finding the most budget-friendly policy, our clients count on us to make the process fast, simple, and stress-free. Here’s what some of them have shared

Reasons to Trust -

We’re not your typical agency—we act fast, file your documents directly, and get you insured in minutes.

We provide direct access to fast, affordable SR-22 and FR-44 insurance. Get covered in minutes—no middlemen, no delays.

Here’s why Florida drivers choose us every day:

SR-22 & FR-44 Specialists

Experts in handling Florida’s required SR-22 and FR-44 filings quickly.

Affordable Rates

Competitive pricing on reliable insurance policies to fit your budget.

Highly Rated by Customers

Over 100 five-star reviews on Google and Facebook from satisfied clients.

Top-Rated Florida Insurance Agents

We specialize in one thing: auto insurance. From license reinstatement to high-risk filings, 5-Star Insurance helps Florida drivers get legal, stay protected, and move forward. We operate like a direct carrier—fast quotes, quick filings, and zero fluff.

Whether you need SR-22, FR-44, or a basic liability policy, our team delivers coverage that meets Florida’s legal standards—without delay, gimmicks, or fine print.

100+

5-Star Reviews

12,000+

Drivers Insured

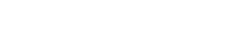

Fast, Easy Mobile Auto Quotes

We’ve simplified auto insurance. Complete our short mobile-friendly form to quickly see affordable options. Get covered instantly, directly from your phone.

Saving You Time.

Customer Satisfaction.

- Specialized SR-22 & FR-44 Coverage

- Fast, Affordable Pricing

- Friendly, Expert Service

Florida’s #1 Auto Insurance Experts

Coverage Tailored to Your Needs

We specialize in essential auto insurance products for Florida drivers:

Auto Insurance

Standard auto coverage for Florida drivers, including liability, comprehensive, and collision options.

Commercial Auto Insurance

Protection for vehicles used for business and commercial purposes.

Liability-Only Auto Insurance

Basic, affordable coverage meeting Florida’s minimum requirements.

SR-22 Insurance

Required filing for drivers needing to reinstate their license after violations.

Motorcycle Insurance

Affordable insurance for motorcycles, scooters, and similar vehicles.

How Getting Insured Works

Securing auto insurance with 5-Star Insurance involves three easy steps. We streamline everything, allowing you to focus on getting back on the road quickly:

Call or Text Us

Tell us about yourself and your vehicle. Our mobile-friendly form or quick phone call gets you started right away.

We Find the Right Policy

We match you with a plan that meets state requirements and fits your budget.

You’re Covered

We file the paperwork and send your proof of insurance. No delays. No confusion.

Clear Answers to Your Auto Insurance Questions

At 5-Star Insurance, we make sure every driver understands their options. Whether you are dealing with a suspension, DUI, or just need affordable coverage, we are here to help you get back on the road with confidence.

Stay Informed with Our Latest Articles

Gain insights to make smarter decisions about your insurance coverage:

Get Your Fast, Free Quote

Insuring your vehicle doesn’t have to be complicated. Reach out directly from your phone, and we’ll secure your coverage quickly and affordably.

Text Us

Phone Number

Address

475 Central Ave, Saint Petersburg, Florida 33701